Investing in jewelry has been a popular investment strategy for many years, and for good reason. There are a number of advantages to investing in jewelry, which make it an attractive option for many investors. In this article, we will explore some of the key advantages of investing in jewelry.

Tangible Asset

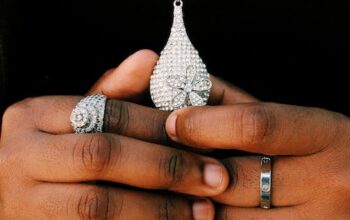

One of the main advantages of investing in jewelry is that it is a tangible asset. Unlike stocks, bonds, or mutual funds, jewelry is a physical object that you can hold and see. This can provide a sense of security, as you have a physical representation of your investment.

Potential Appreciation

Another advantage of investing in jewelry is the potential for appreciation. If you invest in high-quality jewelry, made from precious metals, such as gold or platinum, and if the price of the precious metal increases, then the value of your jewelry can also increase. This can result in a significant return on your investment, over time.

Diversification

Investing in jewelry can also provide diversification for your investment portfolio. By including jewelry in your investment portfolio, you can spread your investment risk across a number of different assets, which can help to reduce your overall investment risk.

Liquidity

Jewelry is a relatively liquid asset, meaning that it can be easily converted into cash, if needed. This can be particularly beneficial, if you need to access your investment funds quickly, or if you are looking to sell your jewelry in the future.

Unique Investment

Investing in jewelry is a unique investment, and it can provide a sense of individuality and personal connection to your investment. This can be particularly appealing to some investors, who are looking for an investment that is not only financially rewarding, but also personally meaningful.

Historical Significance

Some types of jewelry, such as antique or vintage jewelry, have historical significance and rarity, which can increase their value, and make them a lucrative investment. This can be particularly appealing to investors who are looking for a unique, one-of-a-kind investment.

Easy to Store

Jewelry is relatively small and compact, making it easy to store, and it does not require a significant amount of storage space. This can be particularly beneficial, if you are looking to invest in a number of different pieces of jewelry, or if you are limited on storage space.

Portable

Jewelry is also portable, making it easy to take with you, wherever you go. This can be particularly useful, if you are traveling, or if you need to move your investment to a different location, for safety or security reasons.

Low Maintenance

Jewelry requires very little maintenance, and does not require any ongoing costs, such as management fees or maintenance costs. This can be particularly beneficial, if you are looking for a low-cost investment option, that does not require ongoing costs.

Gift Potential

Jewelry can also be given as a gift, which can be particularly meaningful, if the jewelry has sentimental value, or if it is passed down from generation to generation. This can also increase the emotional value of the jewelry, which can be important, when it comes to selling or passing down the jewelry in the future.

Cultural Significance

Jewelry can also have cultural significance, and can be connected to a particular cultural tradition or history. This can add another layer of value to the jewelry, and can make it a more valuable and meaningful investment.

Increased Demand

The demand for precious metal jewelry, such as gold and platinum, has increased significantly in recent years, as people look for safe haven investments, during times of economic uncertainty. This has led to an increase in the price of these metals, and has made jewelry an attractive investment option for many people.

It is important to remember, however, that investing in jewelry is not without its risks, and it is important to carefully consider these risks, before making an investment. For example, jewelry can be lost, stolen, or damaged, which can impact its value, and it can also be difficult to accurately value jewelry, due to its unique and personal nature. Additionally, the price of precious metals can be volatile, and can fluctuate greatly, depending on a variety of factors, such as supply and demand, economic conditions, and political events.

It is also important to note that investing in jewelry should not be considered as a sole investment strategy, and should be part of a well-diversified investment portfolio. This means that it is important to consider other investment options, such as stocks, bonds, mutual funds, and real estate, as part of your overall investment strategy.

It is also important to be aware of the potential for fraud, when investing in jewelry. There are many counterfeit pieces of jewelry on the market, and it can be difficult to determine the authenticity and value of a piece of jewelry. It is important to only purchase jewelry from reputable dealers, and to have the jewelry appraised by a professional, in order to determine its value.

It is also important to consider the tax implications of investing in jewelry. In some countries, the sale of jewelry may be subject to capital gains tax, which can impact the return on your investment. It is important to be aware of the tax laws in your country, and to seek professional tax advice, if necessary, in order to minimize the impact of taxes on your investment.

In addition, it is important to consider the cost of insurance for your jewelry, as it is a valuable asset, and it is important to protect it against theft, loss, or damage. Insurance can be expensive, so it is important to carefully consider the cost of insurance, and to compare insurance options, in order to find the best coverage for your jewelry.

Finally, it is important to keep in mind that investing in jewelry is a long-term investment, and it may take a number of years for the jewelry to appreciate in value. This means that you need to have a long-term investment horizon, and be prepared to hold onto your jewelry for a number of years, in order to potentially see a return on your investment.

In conclusion, investing in jewelry can provide a number of advantages, including the potential for appreciation, diversification, liquidity, and uniqueness. Additionally, jewelry can be a tangible asset, with historical significance, and it is easy to store. By carefully considering these advantages, and seeking professional financial advice, if necessary, you can increase your chances of success, and achieve your financial goals, when investing in jewelry.

Read more about it on related article on link below:

https://www.brillianteers.com/blog/the-perks-of-investing-in-good-quality-jewelry